E-Insurance Account (EIA)

Dematerialization or ‘Demat’ process helps policyholder in creating a portfolio of insurance policies and store them in an electronic form with an insurance repository. You can have only a single ‘e-Insurance Account’ (EIA) with an insurance repository of your choice. An EIA is inclusive of all life insurance policies of the account holder.

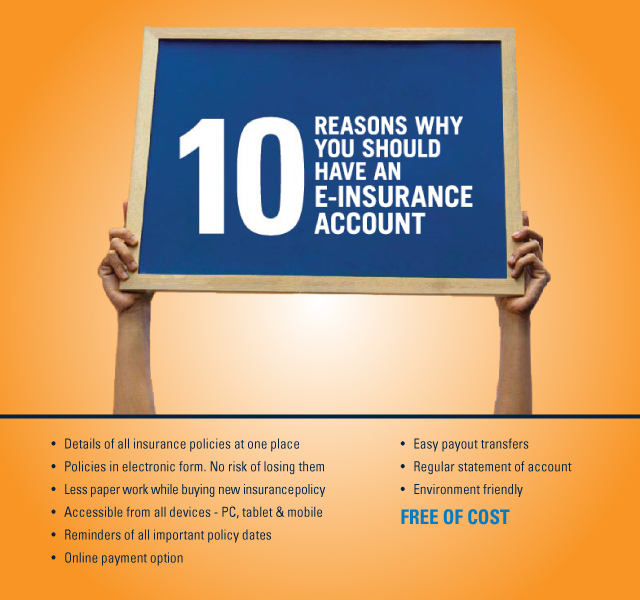

Benefits

- Convenience

- Single Point of Contact

- Eliminates Multiple KYC

- All insurance policies under one umbrella

- Policies in electronic format

- Agent Independent

- Safety

- Risk elimination of Loss due to theft / natural disaster

- Services

- Consolidated insurance statement on an annual basis

- Access anytime anywhere

New Customers

At the time of buying a new policy, submit the eIA application and policy conversion request form along with the new business application form. As per your choice, opt for one among the repositories on application form –

- CAMSRep (M/s CAMS Repository Services Limited)

- CDSL (M/s Central Insurance Repository Limited)

- Karvy (M/s Karvy Insurance Repository Limited)

- NSDL (M/s NSDL Database Management Limited)

Standard application forms for insurance repositories and instructions for filling the same are available under the “Forms and Guidelines” tab.

Insurance Repository role is to provide policy holders a facility to buy and keep insurance policies in electronic form & to bring about efficiency, transparency and cost reduction in the issuance and maintenance of policies. Key offerings of Insurance repository are

- E-Insurance Account (13 digit) creation

- Policy Conversion in electronic form

- Policy level services like Address change , ID change etc.

Existing Policy Holders

As an existing policy holder, in case you do not have an eIA, submit the eIA application form of an insurance repository of your choice along with policy conversion request form.

If you already have an eIA, just submit the policy conversion request form at the nearest Pramerica Life Insurance branch or chosen Insurance Repository office.

All requested existing Pramerica Life policies will be converted into e Policy and sent to you as per email address shared. As per your choice, opt for one among the repositories on application form –

- CAMSRep (M/s CAMS Repository Services Limited)

- CDSL (M/s Central Insurance Repository Limited)

- Karvy (M/s Karvy Insurance Repository Limited)

- NSDL (M/s NSDL Database Management Limited) Standard application forms for insurance repositories and instructions for filling the same are available under the “Forms and Guidelines” tab.

Forms & Guidelines

Instructions and Guidelines for EIA Application Form

![]() Pramerica Life EIA Application Form

Pramerica Life EIA Application Form

Policy Conversion Request Form

![]() Pramerica Life Consent Form

Pramerica Life Consent Form

FAQs

What is Insurance Repository?

“Insurance Repository” means a company formed and registered under the Companies Act, 1956 (1 of 1956) and which has been granted a certificate of registration by Insurance Regulatory and Development Authority (IRDA) for maintaining data of insurance policies in Electronic form on behalf of Insurers. The Insurance Repositories provide the ease of holding insurance policies issued in an electronic form.

What is the objective of an Insurance Repository?

Can any individual/firm act as an Insurance Repository?

Can Insurance repository sell/solicit Insurance policy?

What is an eIA (e-Insurance account)?

- M/s NSDL Database Management Limited

- M/s Central Insurance Repository Limited

- M/s SHCIL Projects Limited

- M/s Karvy Insurance Repository Limited

- M/s CAMS Repository Services Limited

Each e-Insurance Account will have a unique Account number and each account holder will be granted a unique Login ID and Password to access the electronic policies online.