What is RockSolid Future Plan?

UIN: 140N089V02

We all want our tomorrow to be better than our today, whether it is for us or for our spouses, children or senior dependants. But a better life and a better lifestyle for future can only be achieved if you plan and take action for it today. While the future is unpredictable, escalating inflation and expenses are a certainty. Therefore, you need a life insurance plan that ensures that your plans for your future remain Rock Solid even in the face of uncertainty.

Presenting Pramerica Life RockSolid Future, A Non-Linked Non-Participating Individual Savings Life Insurance Plan. A plan designed to help you achieve your vision of a Rock Solid future, be it fulfilling your dreams, building a fortune or planning your retirement income.

Why choose this plan

Learn more about the plan

To receive maturity benefits in a staggered form you can choose either Income Builder Option or Family Income Builder Option. However, if you wish to receive the maturity benefit in one lumpsum then you may choose between Fortune Builder Option and Dream Builder Option.

Plan Option 1: Income Builder Option- If you have begun planning for your retirement or are wanting to build a RockSolid source of second income then the Income Builder option is for you. In this option you will receive a regular income on completion of the policy term and a Lumpsum amount along with the last income instalment which ensures that your source of income continues post your retirement as well.

Plan Option 2: Family Income Builder Option – This option provides enhanced protection to your loved ones over the Income builder Option. In case of an unfortunate demise, in addition to the immediate death benefit, the company will waive off future premiums. Additionally, your family will start receiving the income benefit from next month, for the chosen income benefit period along with a Lumpsum benefit with the last income installment.

Plan Option 3: Fortune Builder Option – Planning to fulfil a lifelong dream? Then the Fortune Builder Option is a suitable choice for you. This option provides all the proceeds under the policy in one lumpsum at the end of the policy term so you can go ahead and lead a life you have always dreamed of.

Plan Option 4: Dream Builder Option – This option provides enhanced protection to your loved ones over the Fortune Builder Option. In case of an unfortunate demise, in addition to the immediate death benefit, the company will waive off all future premiums and the beneficiary will receive the maturity amount when due. With the Dream Builder Option you can ensure that your dreams for your loved ones are realised even in your absence.

Eligibility

Income Builder Option

Age at Entry

1 to 60 years

Maturity Age

18 to 75 years

Premium Payment Term (PPT)

Min: 5 years

Max: 12 years

Policy Term (PT)

Min: PPT

Max: PPT+5 years

Income Period

10, 15, 20, 25, 30, 35 years

Family Income Builder Option

Age at Entry

18 to 50 years

Maturity Age

23 to 67 years

Premium Payment Term (PPT)

Min: 5 years

Max: 12 years

Policy Term (PT)

Min: PPT

Max: PPT+5 years

Income Period

10, 15, 20, 25, 30, 35 years

Fortune Builder Option

Age at Entry

For 5 PPT: 91 days to 55 years For other than 5 PPT: 91 days to 60 years

Maturity Age

18 to 75 years

Premium Payment Term (PPT)

Single Pay: One Time, Limited Pay: 5 to 12 years

Policy Term (PT)

Single Pay: 10 to 20 years, Limited Pay: PPT + 5 years to 30 years

Income Period

NA

Dream Builder Option

Age at Entry

18 to 50 years

Maturity Age

28 to 75 years

Premium Payment Term (PPT)

Min: 5 years

Max: 12 years

Policy Term (PT)

Min: PPT+5 Years

Max: 30 years

Income Period

NA

Installment Premium

Single

₹ 30,000

Annual

₹ 12,000

Semi-annual

₹ 6,120

Monthly

₹ 1,032

Maximum: No Limit, subject to Board Approved Underwriting Policy

All reference to age are based on age as on the last birthday. Substandard lives may also be covered subject to Board Approved Underwriting Policy and with any extra Premium, if applicable. Taxes as applicable will be charged over and above the quoted Premium.

Benefits of buying a RockSolid Future Plan

This product provides four Plan Options to choose from, these options help you customize the plan according to your individual needs. Your benefits will vary depending upon the plan option chosen. Let’s look at the benefits in detail:

For Income Builder Option: In the unfortunate event of death of the Life Insured during the Policy Term while the policy is in-force on the date of death, the beneficiary shall receive the death benefit which shall be highest of:

1. Sum Assured on Death^ (or)

2. 105% of the Total Premiums paid* till the date of death for Regular/ Limited Pay Policies(or)

3. Surrender Value as on date of death

Upon the payment of death benefit, the policy shall terminate and no further benefits shall be payable.

For Family Income Builder Option: In the unfortunate event of death of the Life Insured during the Policy Term while the policy is in-force on the date of death, the beneficiary shall receive the death benefit which shall be highest of:

1. Sum Assured on Death^ (or)

2. 105% of the Total Premiums paid* till the date of death for Regular/ Limited Pay Policies

Additionally, the Company shall pay Guaranteed Income Benefit from the next month as per the chosen Income Payout Frequency post date of death till the end of the Income Period chosen at the outset along with Guaranteed Lumpsum Benefit at the end of Income Period to the nominee.

The policy shall terminate on payment of Guaranteed Lumpsum Benefit and no further benefits shall be payable

For Fortune Builder Option: In the unfortunate event of death of the Life Insured during the Policy Term while the policy is in-force on the date of death, the beneficiary shall receive the death benefit which shall be highest of:

1. Sum Assured on Death^ (or)

2. 105% of the total premiums paid* till the date of death for Regular/Limited pay policies(or)

3. Surrender Value as on date of death

Upon the payment of death benefit, the policy shall terminate and no further benefits shall be payable.

For Dream Builder Option: In the unfortunate event of death of the Life Insured during the Policy Term while the policy is in-force on the date of death, the beneficiary shall receive the death benefit which shall be highest of:

1. Sum Assured on Death^ (or)

2. 105% of the total premiums paid* till the date of death for Regular and Limited Pay Policies

Additionally, the Company shall pay Guaranteed Maturity Benefit along with all Loyalty Boosters at the end of the policy term to the nominee.

Upon the payment of Guaranteed Maturity Benefit and Loyalty Boosters, the policy shall terminate and no further benefits shall be payable.

Note (For all Plan Options)

# Annualized premium shall be the premium payable in a policy year chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any. Total Annualized Premiums payable is the sum total of annualized premium for the entire premium payment term as per the policy contract.

*Total Premiums paid means total of all the premiums received, excluding any underwriting extra, any rider premium and taxes.

^ Sum Assured on Death is defined as 11 times Annualized Premium in case of Limited/Regular Pay and 1.25 times Single Premium in case of Single Pay

If you are unable to pay your premium by the due date, you will be given a grace period of 15 days for monthly mode and 30 days for all other premium payment modes. During the grace period the Policy shall continue to remain in force along with all the benefits under this policy and claim, if any, shall be payable subject to deduction of the unpaid due premium till the date of death.

You can revive your lapsed/Paid-up policy for its full coverage within five years from the due date of the first unpaid premium but before policy maturity, by paying all outstanding premiums together with the interest, as applicable. The interest for revival of the policy will be charged at market related rates set by the Company from time to time. The rate of interest shall be reset on an annual basis at the beginning of every financial year (April) and would be determined based on the average of 10-year G-Sec YTM plus 75 basis points rounded down to 25 basis points. The average of the benchmark would be taken from the previous financial year for the period 1st July to 31st Dec. The source of information for 10 year G Sec rate would be “CCIL”. The current applicable rate of interest on policy reinstatement is 8.00% p.a. compounding monthly which would be applicable for the FY 2024-25. Revival of the policy is subject to Board approved underwriting policy, i.e. the Life Insured may have to undergo medical tests, financial underwriting etc. If a lapsed policy is not revived within the revival period, the policy will terminate on expiry of the revival period.

It is advisable to pay premiums for the entire premium payment term to enjoy maximum benefits under the policy. The policy will acquire Surrender value after paying premium for the first complete policy year & will

become payable after completion of first policy year. Thereafter, if you decide not to pay further Premiums,

you would have the option to either surrender the Policy or let the Policy continue with reduced benefits in

accordance with the conditions mentioned in the Premium Discontinuance section. If you choose to

discontinue your policy, you will be entitled to receive Surrender Value which will be higher of the

Guaranteed Surrender Value (GSV), if applicable or Special Surrender Value (SSV) of the Policy. Please refer

to policy document for details.

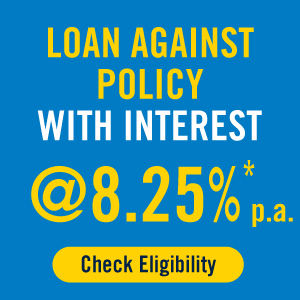

You may take a loan against your Policy once it has acquired a Surrender Value. The maximum loan that can

be availed is 75% of the Surrender Value at any time. The rate of interest shall be reset on an annual basis

at the beginning of every financial year. The rate of interest applicable on the loan will be declared by the

Company on an annual basis at the beginning of every financial year. The loan rate of interest is based on

yield on 10-years GSEC YTM plus 150 basis points rounded down to 25 basis points. The average of the

benchmark would be taken from the previous financial year for the period 1st July to 31st Dec. The source

of information for 10 year GSec rate would be “CCIL”. The current applicable rate of interest for FY 2024-25

is 8.75% p.a. Compounding monthly. Any outstanding loan amount together with any unpaid interest

thereon shall be adjusted against any Policy Benefit which become payable under the Policy.

For other than in force and fully paid up policies: In case outstanding loan amount including interest exceeds

the surrender value, the policy will get foreclosed after giving intimation and reasonable opportunity to the

policyholder to continue the policy.

Why choose Pramerica Life Insurance?

Unshakeable life insurance products tailored for your needs

A knowledgeable you is an informed you

Disclaimer:

This product provides Life Insurance coverage. Pramerica Life RockSolid Future - A Non-Linked Non-Participating Individual Savings Life Insurance Plan. UIN: 140N089V02. Goods & Services Tax will be charged over and above the quoted premium. *Tax Benefits may be available as per the applicable laws as amended from time to time. This plan offers guaranteed benefits provided the policy is in force and all due premiums are paid in full. For more details on risk factors and terms & conditions including policy exclusion, please refer to the detailed plan brochure and policy terms and conditions before concluding a sale.

Guaranteed benefits: No ambiguity and no surprises.

Guaranteed benefits: No ambiguity and no surprises.

.jpg)

.jpg)