What is RockSolid Term Insurance?

UIN: 140N079V01

Presenting Pramerica Life RockSolid Term Insurance, a tailor made pure risk life insurance plan that provides protection as per your needs. It comes with a wide range of flexibilities that help you design your Rock Solid safety net so that you can secure your family’s financial future, even in case of unfortunate events.

Why choose this plan

Learn more about the plan

Optional covers

Increasing Life Cover

This option allows you to increase your sum assured by either 25% or 50% twice during the policy term, where the first increase takes place on completion of the 5th policy year and the second and final increase takes place on completion of the 10th policy year.

You have to choose the rate of increase at inception of the policy. After the last increase in Sum Assured at the completion of the 10th Policy Year, the Sum Assured stays at the same level throughout the remaining Policy Term. Increasing Life Cover shall be applicable to lives accepted as standard risk. Conversion of policy from Regular to Limited Pay shall not be allowed under Increasing Life Cover.

Life Stage Cover Enhancement

This option offers you the flexibility to increase the Base Sum Assured twice during the Policy Term on occurrence of any of the following listed life stage events and on payment of an additional premium, without undergoing any further medical underwriting. Depending on the event that has occurred, the Sum Assured can be increased by an amount equal to 25% or 50% of the Base Sum Assured, subject to a maximum increase of 100% of the Base Sum Assured but not exceeding Rs. 1 Crore.

The facility can be exercised on occurrence of any of the following events:

| Event | Additional Cover |

|---|---|

| Marriage (Once during the policy term, not available if already married) | Min. of (50% of Base sum assured chosen at inception or ₹50 lakh) |

| Birth/Legal Adoption of 1st Child | Min. of (25% of Base sum assured chosen at inception or ₹25 lakh) |

| Birth/Legal Adoption of 2nd Child | Min. of (25% of Base sum assured chosen at inception or ₹25 lakh) |

| On purchase of house (Once during the policy term) | Min. of (50% of Base sum assured chosen at inception or ₹50 lakh) |

Spouse cover

This option provides add-on cover for the spouse (secondary life) which shall trigger only at the death of the Primary Life Insured. At inception, Policyholder shall have the flexibility to choose the Sum Assured for Spouse (secondary Life) between 20 Lakhs to 50 Lakhs, subject to a maximum of 50% of the Base Sum Assured chosen by the Primary Life at inception. On death of the Primary Life Insured, the death benefit as applicable shall be payable and the life cover for spouse will get triggered for the remaining policy term or till the end of policy year in which the spouse attains age of 85 years, whichever is earlier. No future premiums are to be paid by the Secondary life and on death of the Spouse (secondary life) during the remaining policy term or till attainment of age 85 (Whichever is earlier), the applicable Spouse Cover Sum Assured shall be payable.

If the Spouse (secondary Life) dies before the death of the Primary Life Insured, this benefit will not be available, as the Spouse Cover gets triggered only after the death of the Primary Life Insured.

Eligibility

Age at entry

Minimum

Other than spouse cover: 18 years

Maximum

For Regular pay: 65 years

For Limited Pay (5/10/15 Years): 65 years

For Pay till Age 60: 55 years

In case of Spouse cover: 21 years for both Primary Life and Secondary Life

In case of Spouse Cover: 55 years for both Primary Life and Secondary Life

Maturity age

Minimum

28 years

Maximum

85 years

Policy term

Minimum

10 years

Maximum

30 years and upto 65,70,75,80,85

Premium payment term

Regular Pay

Equal to policy term

Limited Pay

5, 10, 15, to Age 60

Single Pay

One time payment

Premium payment frequency

Annual

Semi Annual

Monthly

Sum Assured (in INR)

Minimum

50,00,000

Maximum

Subject to board approved underwriting policy

What are riders and types of riders?

Riders are additional benefits that you can choose to include with your existing insurance policy as per your needs. With RockSolid Term Insurance plan, you can enhance your insurance coverage during the policy term by adding following riders at a nominal extra cost over and above your base policy premium:

Pramerica Life Accidental Death Benefit Rider

This rider completes your circle of protection by providing additional protection against an unfortunate demise resulting from an accident.

Pramerica Life Accidental Total and Permanent Disability

This Rider can be added to your base policy to provide you with additional protection against unforeseen circumstances like total and permanent disability due to accident.

Pramerica Life Critical Illness Rider

This rider enables you to get the best treatment available and takes care of the indirect expenses while you recover from any of the listed critical illness. The customer will receive a lumpsum amount upon being diagnosed with any of the listed critical illness.

Pramerica Life Waiver of Premium Rider

This Rider protects your loved ones from the adverse effects of unforeseen events like Death, Accidental Total and Permanent Disability and Critical Illness. All future premiums of the base policy and riders premiums (if any) including modal loading and underwriting extra premium if any shall be waived off on the occurrence of covered contingency.

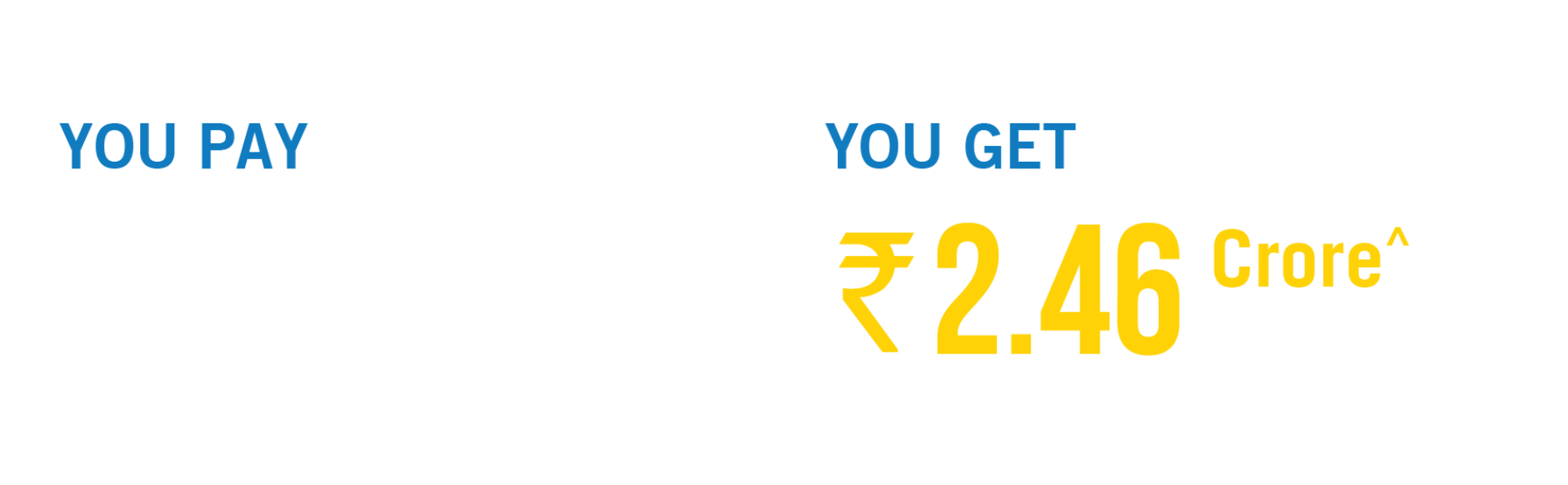

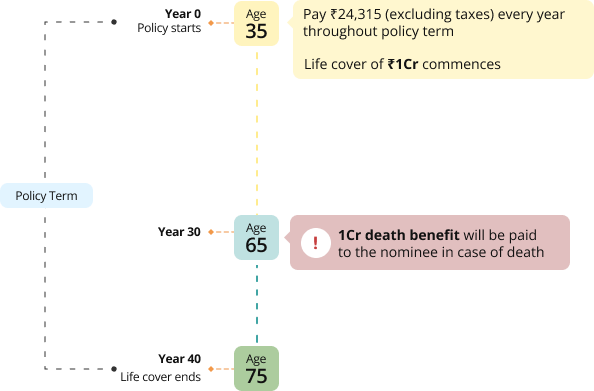

Benefit illustration

This is Manish

Manish a non-smoker, 35-year-old doctor, has just invested in opening a new clinic and wants to safeguard his family from financial uncertainties that could arise in case of his untimely demise. He purchases Pramerica Life RockSolid Term Insurance, for a Sum Assured of 1 Crore and chooses a policy term up to the age of 75 years and chooses to pay premium annually for the entire policy term.

Why choose Pramerica Life Insurance?

Unshakeable life insurance products tailored for your needs

A knowledgeable you is an informed you

**Receive Total Premiums Paid (excluding rider premiums and applicable GST) on exiting the policy before end of the policy term. Please refer to the terms and conditions for details.

This product provides Life Insurance coverage. Pramerica Life RockSolid Term Insurance UIN: 140N079V01. The Company will deduct charges for goods and service tax applicable on products at the rate as notified by the Government of India from time to time. For more details on risk factor, terms and conditions please refer to our website before concluding a sale. Tax Benefits may be available as per the applicable laws as amended from time to time. This plan offers guaranteed benefits provided the policy is in force and all due premiums are paid in full.

Option to increase sum assured up to 200% of the base cover

Option to increase sum assured up to 200% of the base cover

.jpg)

.jpg)