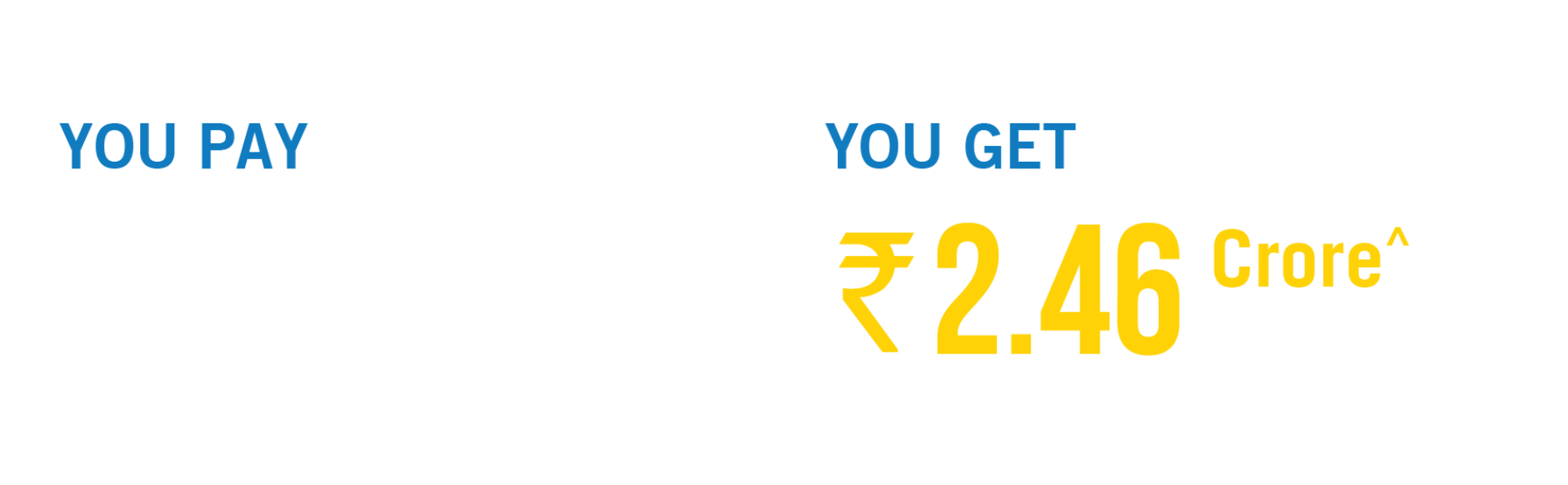

Optimise Returns from Your Savings With Super Investment Plan

UIN: 140L088V05

It is time to save in the right instrument that not only helps you optimise returns but, in your absence, also provides a safety net through a life insurance cover. With Pramerica Life Super Investment Plan, you can enjoy the benefit of life cover and secure your family’s future against uncertainties of life. With this, you can easily fulfil your life goals by choosing from three different plan options for different life stage needs.

Features of a Super Investment Plan

Learn more about the plan

Eligibility

Parameters/Option

Wealth Builder

Dream Builder

Inheritance Builder

Age## at Entry

Min: 90 Days

Max: 65 years

Min: 18 years

Max: 45 years

Min: 90 Days

Max: 65 years

Maturity Age##

Min: 18 years

Max: 75 years

Min: 28 years

Max: 75 years

Min: 99 Years

Max: 99 years

Policy Term

10,15,20,25 & 30 years

10,15,20,25 & 30 years

99 minus Age at Entry

Premium Payment Term (PPT)

Policy Term (years)

10

15

20/25/30

Premium Payment Term (years)

5 to 9

5 to 14

5 to 15

7,10,12 and 15 years

Premium (Rs.)

Premium

Annual

Semi-Annual Quarterly

Quarterly

Monthly

Min

Rs.12,000

Rs.6,000

Rs. 3,000

Rs.1,000

Max

No Limit; subject to Board Approved Underwriting Policy

Sum Assured (Rs.)

Less than 50 yrs. : 7/10 times AP$

50 yrs. to 55 yrs. :5/10 times AP$

56 yrs. and above : 5 times AP$

Premium Payment Frequency

Annual, Semi-Annual, Quarterly & Monthly **

##Age as on last birthday

Benefits of buying a Super Investment Plan

Avail additional benefits while enjoying the peace of mind knowing that your loved ones are financially protected and also having the potential to earn higher returns on your investments

Death benefit

In case of an unfortunate demise of the life insured during the Policy Term provided all due premiums are paid, the following benefits shall be payable:

For Wealth Builder and Inheritance Builder Option:

Death Benefit shall be higher of

Sum Assured* including Top-up Sum Assured , if any or

Fund value, including top-up fund value, if any, or

105% of total premiums paid till date of death, including top-up premiums, if any

Where, Sum Assured is a multiple of Annualized premium based upon the age at entry of the life insured

For Dream Builder Option:

Death Benefit shall be

- Immediate Lump Sum on Death of Life Insured:A lump sum benefit equal to higher of the sum assured* including top-up Sum Assured, if any, or 105% of total premiums paid including Top-Up premiums, if any, shall be immediately paid to the nominee or the beneficiary as the case be and

- Waiver of future premiums (WOP): All future premiums will be paid into the policy by the company as and when they are due till the end of Premium Payment Term

- Fund Value at Maturity: Fund Value, including Top-Up fund value, if any, at Maturity shall be paid to the nominee or the beneficiary as the case be

*Sum Assured will be reduced to the extent of partial withdrawals made in the last 2 years immediately preceding the date of death. The partial withdrawal made from the Top-Up premium shall not be reduced for this purpose.

On survival of the Life insured till maturity date, the Fund Value including Top-Up fund value, if any, shall be payable and the policy shall terminate.

The policy will acquire surrender value immediately from first policy year. However, no surrender value will be payable during the “lock in period”, which is a period of five consecutive policy years from the date of commencement of the policy.

If the Policyholder opts for surrender within first five policy years, the Fund Value, after deducting the applicable discontinuance charges, shall be credited to the Discontinued Policy Fund and the risk cover and rider cover, if any, shall cease. The proceeds from the Discontinued Policy Fund shall be paid at the end of the lock in period as Sum Assured . Only fund management charge shall be deducted from this fund during this period.

The income earned on this fund shall be at least the minimum rate as prescribed by the IRDAI from time to time. The current prescribed minimum guaranteed rate of interest applicable is 4% percent per annum. The excess income earned in the Discontinued Policy Fund over and above the minimum guaranteed interest will also be accounted to the Discontinued Policy Fund.

If the policyholder opts for surrender after the completion of the fifth policy year, the Fund Value if any will be paid.

Persistency Units

As a reward for continuing your policy (i.e. when all due premiums are paid), Persistency units as per the below table shall be added to your Fund(s). Persistency units will be calculated as a percentage of the average of Fund Value (including Top-Up premium fund value) of preceding 36 monthly policy anniversaries and will be allocated to your unit account at the end of every policy year, starting from the end of the sixth policy year.

| Plan Options | Wealth builder and Dream builder option | ||

|---|---|---|---|

| Policy year(PY)/Premium Band | Premium Band-1 (Rs.12,000 to Rs. 59,999) | Premium Band-2 (Rs.60,000 to Rs.1,19,999) | Premium Band-3 (Rs.1,20,000 & above) |

| From end of 6th PY | 0.00% | 0.10% | 0.25% |

| Plan Options | Inheritance builder option | ||

| From end of 6th PY | 0.00% | 0.10% | 0.25% |

| From the End of 31st PY | 1.00% | ||

Persistency Boosters

Provided all due premiums are paid in all the three plan options, in addition to Persistency Unit mentioned above, Persistency Boosters would be allocated as extra units at the end of every fifth policy year, starting from the end of tenth policy year till the end of 30th policy year. Persistency Booster as a percentage of average Fund Value including Top-Up Fund Value of preceding 36 monthly policy anniversaries would be allocated to the policyholder’s unit account at the end of 10th, 15th, 20th, 25th and 30th policy year, if they fall within the prevailing policy term.

| Policy Year (PY)(End of Year) | Premium Band 1 (Rs.12,000 to Rs. 59,999) | Premium Band 2 (Rs.60,000 to Rs.1,19,999) | Premium Band 3 (Rs.1,20,000 & above) |

|---|---|---|---|

| 10th | 1.50% | 2.00% | 2.50% |

| 15th | 2.00% | 2.50% | 3.00% |

| 20th | 2.50% | 3.00% | 3.50% |

| 25th | 3.00% | 3.50% | 4.00% |

| 30th | 3.50% | 4.00% | 4.50% |

Choice of investment strategies

At inception, the Policyholder can choose one of the below investment strategies.

Within the Defined Portfolio Strategy, the Policyholder can choose to invest with or without the Systematic Transfer Plan Option. Once opted in, the investment strategy will continue throughout the policy term. You cannot switch from one investment strategy to another during the policy term.

Under this option, you can choose to invest in any of the funds as available (except discontinued policy fund or Liquid Fund) in proportion to your choice. Within the Defined Portfolio strategy, you also have the option to select the Systematic Transfer Plan (STP) option for which Liquid Fund will be made available to you. You can switch monies amongst these funds using the switch option.

You can choose from Six funds to invest your money in. You can look at the investment objectives of each of our funds to evaluate and match your investment goals to decide the proportion of investment in each of them. If you opt for more than one fund, the minimum investment in any fund should be at least 1% of the Annual Premium paid. The funds and fund objectives are as follows:

Why choose Pramerica Life Insurance?

Need assistance?

We are happy to help you. Talk to our expert and choose the right plan as per your needs.

Unshakeable life insurance products tailored for your needs

A knowledgeable you is an informed you

Disclaimer:

This product provides Life Insurance coverage. Pramerica Life Super Investment Plan. UIN: 140L088V05. This material gives the salient features of the product. For more details on risk factors and terms & conditions including policy exclusion, please refer to the detailed plan brochure and policy terms and conditions before concluding a sale. Goods & Service Tax will be charged over and above the quoted premium. Tax Benefits may be available as per the applicable laws as amended from time to time.

Secure family’s future against uncertainties

Secure family’s future against uncertainties Plan options for different life stage needs

Plan options for different life stage needs

.jpg)

.jpg)