What is a Term Insurance Plan?

Term Insurance, as the name suggests, provides coverage for a specific time, also called term. In this case, if there is an unfortunate demise of the insured during the policy term, the nominee is offered financial benefit also called death benefit. This sum of money helps the nominee to:

- Keep up with their monthly living expenses

- Pay off financial liabilities (if any) like a house or a car loan

- Invest in their life goals such as children’s education and marriage

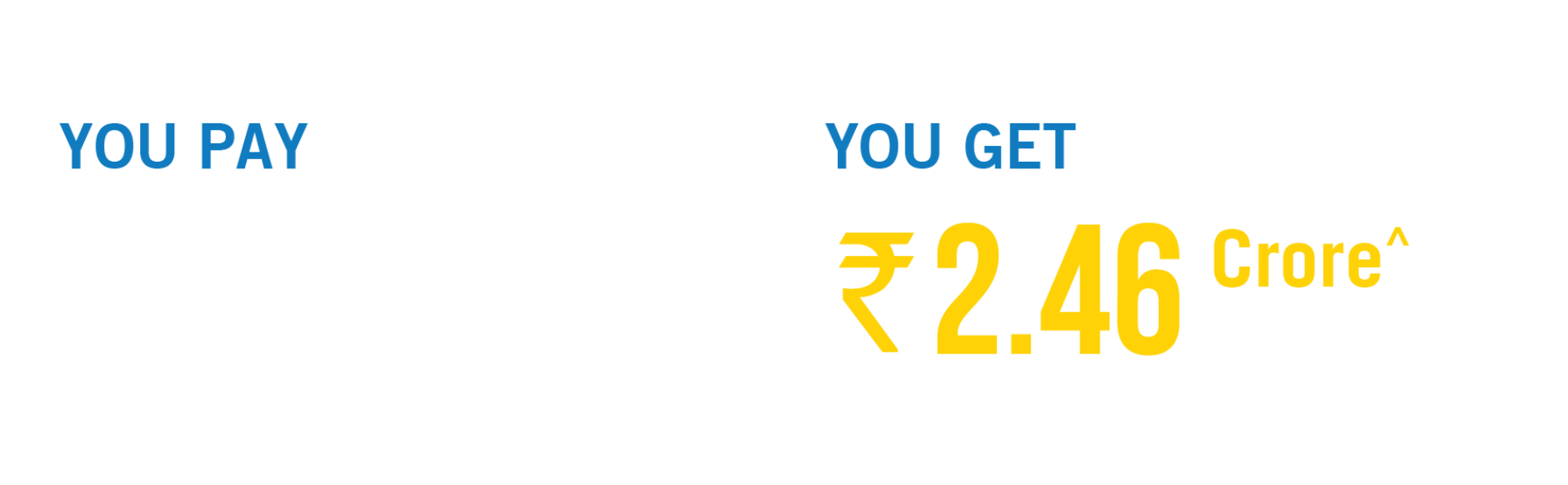

Generally, Term Life Insurance policies offer high life cover in return of lower premiums. The frequency of the premium payment for the insurance plan can be paid at once or at regular intervals. In every insurance, the premium amount varies depending on factors, including the payment method opted by the insured.

Explore our wide range of best money saving plans

Who should buy a Term Insurance Policy?

Any individual with financial dependents should consider purchasing a Term Life Insurance Policy. This is a broad category that includes people from various backgrounds, such as SIP investors, self-employed individuals, business owners, married couples, young professionals, etc.

Term Insurance Policies offer benefits to taxpayers in terms of tax savings and protection. The insurance premiums paid are deductible from taxable income under Section 80C of the Income Tax Act, 1961. Some of the potential groups that could benefit from Term Insurance are outlined below:

Parents play a crucial role in providing for their children's needs, including education and living expenses. However, unforeseen events can jeopardise their financial stability. A Term Life Insurance Policy offers a dependable solution by providing a lump sum or monthly payout to ensure that the essential needs of their children are met even in the parents' absence.

A thoughtful and enduring gift for newly-married couples is financial security through Term Insurance. In case of an unfortunate event, this insurance ensures the surviving spouse's financial well-being, enabling them to navigate life's challenges without worrying about financial stability.

In today's world, women are active contributors to their family's financial well-being. Term Insurance becomes paramount to guarantee the family's financial security if something were to happen to the woman. It not only ensures the financial support of children or parents but also help fulfill existing liabilities like education, auto, or home loans.

Young professionals often face financial stress while striving to establish themselves in their careers. Term Insurance offers a stable financial future by keeping premiums consistent throughout their lives, providing peace of mind and a foundation for financial security, especially during uncertain times.

Opting for Term Insurance can also yield tax benefits, as premiums are deductible under section 80C of the Income Tax Act, 1961. Moreover, the maturity amount is exempted under section 10D, significantly reducing the tax burden while ensuring financial security for loved ones.

Self-employed individuals face financial volatility due to irregular income and potential business loans. Term Insurance acts as a crucial safety net, ensuring the financial stability of their families even in challenging times. It offers peace of mind and a reliable plan to secure the future.

Systematic Investment Plan (SIP) investors rely on consistent investments to build wealth. Term Insurance safeguards this investment by ensuring regular asset provision to the nominees in the event of the investor's unfortunate demise, maintaining the flow of investments and securing financial futures.

Even in retirement, Term Insurance plays a vital role. It can be a means to leave a lasting inheritance for your family, ensuring their financial security and well-being. This financial cushion ensures peace of mind for retirees, knowing their loved ones are taken care of.

Features of a Term Insurance Plan

A reliable Term Insurance Plan is synonymous with financial security and a well-planned future. Below, you will find some essential features of a Term Insurance Plan:

Benefits of buying a Term Insurance Plan

An effective Term Life Insurance Plan protects you and your family members, providing a financial cushion even in your absence. It is never too late to purchase your policy and pave the way for a financially secure future.

The right time to buy a Term Insurance Policy

The right time to buy a Term Life Insurance Policy is as soon as possible. As you age, the chances of developing diseases increase. Additionally, your insurance costs also rise with age, resulting in higher premiums.

If you purchase an insurance plan at a young age, you can enjoy several benefits. The primary advantage is an affordable premium. Therefore, it is advisable to invest in your Term Insurance Plans when you are young. This will help you save a substantial amount of money in the long run and prepare a financial cushion for times of need. Furthermore, you have the option of extended coverage, enabling you to provide financial security to your loved ones from an early age.

What should be the duration of your Term Insurance Plan?

The duration of your Term Insurance Plan signifies the period of financial protection that you and your family will receive. Every family has various financial goals, and the duration of the Term Plan depends on these goals. To maximise the benefits, it is advisable to opt for the longest available duration. Additionally, several factors should be considered when deciding the direction for your Term Life Insurance Policy.

How to choose the best Term Insurance Plan?

Factors that impact Term Insurance Premium

1. Age

2. Gender

3. Profession

4. Duration/policy term

5. Medical History

6. Smoking/Drinking

7. Personal health

What is a Term Insurance rider?

A Term Insurance rider offers various add-on covers that can be purchased in addition to the base plan. Riders come at an additional cost on top of the premium and can be chosen based on different needs and preferences. There are several types of riders, as outlined below:

How to buy Term Insurance?

-

1

Estimate Your Sum Assured

To initiate the process of purchasing Term Insurance, analyse your financial needs and visit the website to calculate the premium. You will find a calculator that requests your basic information, including your name, age, contact information, smoking habits, annual income, etc.

-

2

Choose Your Benefits & Get a Quote

When purchasing your Term Insurance, you can select from various benefits, such as different payout options, critical illness benefits, and more.

-

3

Fill the Details & Pay the Premium

After making your choices, you can provide additional details and submit the required documents. This will complete your application to buy a life term insurance policy.

A knowledgeable you is an informed you

Why choose Pramerica Life Insurance?

Disclaimers:

*Individual death claims settled and reported in public disclosures for FY 2022-2023

^ As on 31st September 2023

.png)

.png)

.png)

.jpg)

.jpg)