What is Wealth Enhancer Plan?

UIN: 140L070V02

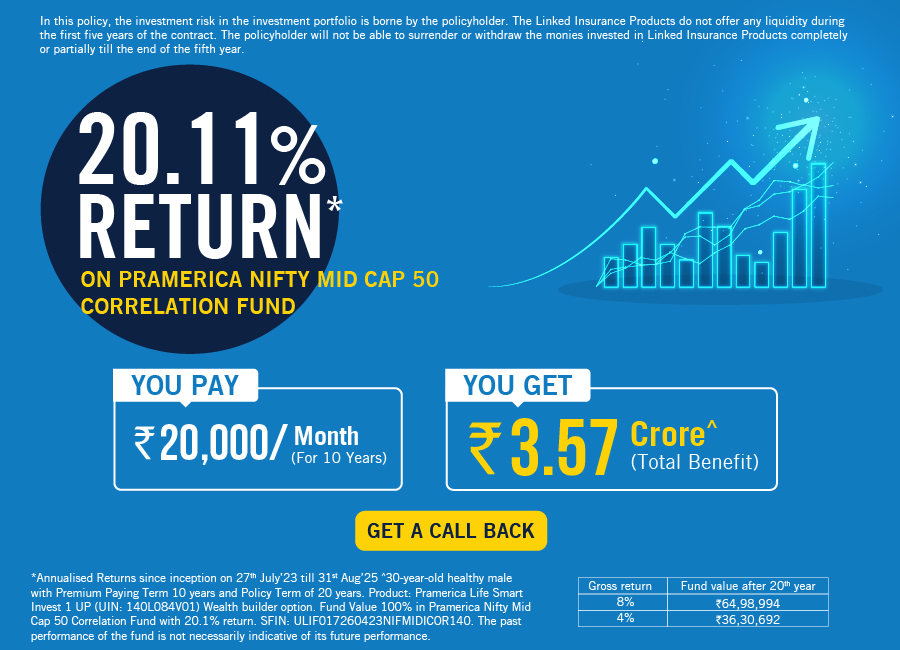

Apart from a person’s need based and predictable financial plans, there are times in life when one has a lump sum of money and they look for avenues to secure their family’s future. In this case, one would look for a product that helps you achieve all your financial goals and secures your family against the uncertainties of life. We, at Pramerica Life, have embedded all these needs in a single pay ULIP plan. A perfect combo of savings & protection.

Features of a Wealth Enhancer

Learn more about the plan

Eligibility

Age at Entry##

Minimum: 1 Years

Maximum: 70 Years

Maturity Age##

Minimum: 18 Years

Maximum: 75 Years

Policy Term

Age at Entry of Life Insured

1 to 40

41 to 45

46 & Above

Option-A

5 to 20

5 to 10

NA

Option-B

5 to 20

5 to 20

5 to 20

Option A: Sum Assured is 10 Times of Single Premium

Option B: Sum Assured is 1.25 Times of Single Premium (for Age at Entry <50 years) and 1.10 Times of Single Premium (for Age at Entry >=50)

Premium Payment Term

Single Pay

Premium

Minimum Premium: ₹2,00,000

Maximum Premium: Subject to Board Approved Underwriting Policy

Minimum Sum Assured

Age at Entry/Option

1 to 45

years

46 to 49 years

50 years and Above

Option-A

10 x Single Premium

NA

NA

Option-B

1.25 x Single Premium

1.25 x Single Premium

1.10 x Single Premium

Maximum Sum Assured

Age at Entry/Option

1 to 45

years

46 to 49 years

50 years and Above

Option-A

10 x Single Premium

NA

NA

Option-B

1.25 x Single Premium

1.25 x Single Premium

1.10 x Single Premium

Premium Payment Mode

Single Pay

##Age as on last birthday

Benefits of Buying a Wealth Enhancer Plan

In case of an unfortunate demise of the Life Insured during the Policy Term, nominee shall receive Death Benefit which is higher of

a) Sum Assured* (reduced by applicable partial withdrawal) or

b) Fund Value or

c) 105% of Single Premium

*Sum Assured will be reduced to the extent of partial

withdrawals made in the last 2 years immediately preceding the

date of death.

On survival of the Life Insured till maturity date Fund Value will be paid to you.

Death cover chosen will cease on Maturity

A Policy issued under this plan will acquire Surrender Value on payment of Single Premium. However no Surrender Value will be payable during the Lock-in Period which is a period of 5 consecutive Policy years from the date of commencement of the Policy.

The surrender value will be the value of units less

discontinuance (or surrender) charges. There are no

discontinuance charges from 5th year onwards.

Within Defined Portfolio Strategy, you can switch your investments within the available funds, depending on your financial priorities and investment decision. Four switches in a policy year are free of cost and any subsequent switch in the year will be charged a fee of ₹250 per switch. There is no restriction on number of switches during entire policy term. No switching charge will be levied for switching from Liquid Fund to the chosen Funds in case STP is opted for.

The minimum switch amount is ₹5000 unless 100% of the fund is switched.

Switching between the funds will not be allowed in case

Policyholder has opted for Life Stage Portfolio strategy

To manage any unexpected need for money or for any exigency, partial withdrawals can be made from your investment account only after completion of 5 Policy Years (Lock-in Period) provided monies are not in Discontinued Policy Fund. The total amount of partial withdrawals in a policy year cannot exceed 20% of fund value as at the beginning of the policy year in which partial withdrawal is made. After making a partial withdrawal, you will have to wait for two years from the date of previous partial withdrawal to avail next partial withdrawal. A total of 5 partial withdrawals are allowed during the entire term of the contract. The minimum withdrawal amount is ₹10,000

For policies where life insured is a minor, Partial withdrawal is not allowed until the minor life insured, if applicable attains majority i.e. on or after the attainment of age 18.

Partial withdrawal will not be allowed in case doing so would lead the contract to terminate.

Within Defined Portfolio Strategy the Company will give you an option to preserve your fund value towards the end of your Policy, when your investments are due to be paid back. You should notify the Company 30 days before the start of the last policy year when the right to exercise this option becomes available.

For example:

Policy Issuance Date: 1st Jan 2019,

Policy Term: 10 Years

Last Policy year Starts from: 1st Jan 2028.

The Policyholder has an option to inform the Company 30 days before 1st Jan 2028, i.e. any time before 2nd Dec 2027.

All your investments are systematically transferred from funds of your choice to Liquid Fund in the last 12 months of the Policy. Every month 1/N of the units will be transferred from chosen fund/s to Liquid fund.

Where, N= Number of months remaining under the FCO option.

Tax benefits may be applicable as per prevailing tax laws. Tax

laws are subject to change. Please consult your tax advisor for

details.

Why choose Pramerica Life Insurance?

Unshakeable life insurance products tailored for your needs

A knowledgeable you is an informed you

Disclaimer:

NOTE: IN THIS POLICY, THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER. This product does not offer any liquidity during the first five years of the contract. The Policyholder will not be able to surrender or withdraw the monies invested in this product completely or partially till the end of the fifth year.

Pramerica Life Wealth Enhancer: 140N070V02.This product provides life insurance coverage. Applicable Taxes will be charged over and above of the applicable charges from the unit fund. For more details on risk factors and terms & conditions including policy exclusion, please refer to the detailed plan brochure and policy terms and conditions before concluding a sale.

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS / FRAUDULENT OFFERS. IRDAI or its officials do not involve in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

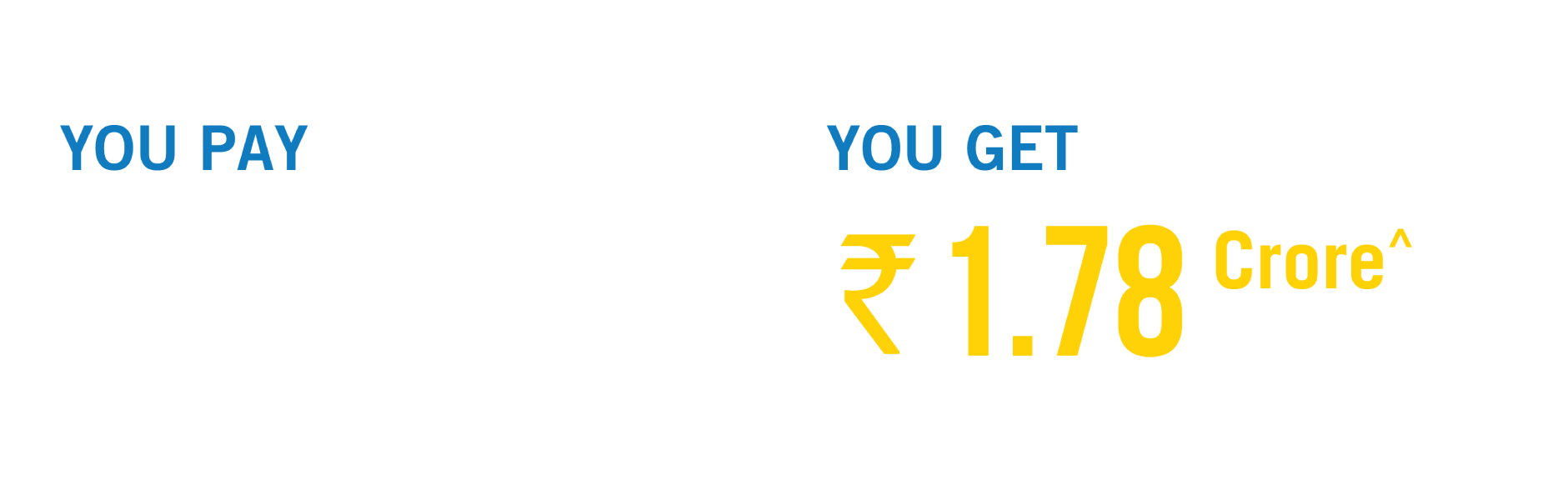

Pay just once and enjoy benefits up to 20 years.

Pay just once and enjoy benefits up to 20 years. Avail tax benefit as per the prevailing tax laws

Avail tax benefit as per the prevailing tax laws

.jpg)

.jpg)