Become An Advisor

What if you had the chance to start a business that would:

- Need no additional set up cost?

- Run parallel to your existing business?

- Give you a chance to generate high income?

- Take you to international destinations?

And most importantly, give you the chance to help others. Sounds impossible?

When you join Pramerica Life Insurance, it’s all possible.

Whether you are looking at a business opportunity that you can run parallel to your existing business or at a full time engagement at Pramerica Life Insurance, we will help you establish your Life Insurance business.

Start your success journey with us.

What Our Advisors Have To Say

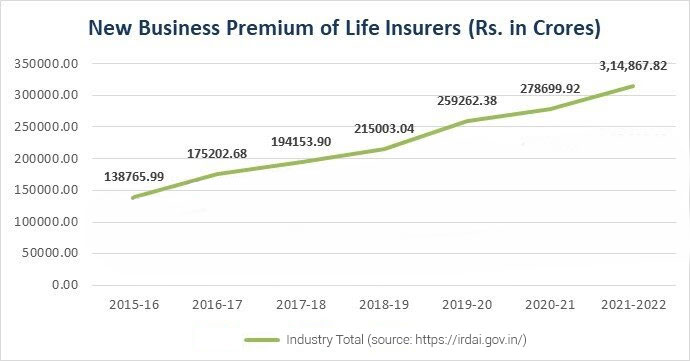

Growing Industry

- Indian life insurance market has grown phenomenally over the past few years

- Some of the largest companies in the world are now investing in this sector

- Rapid development in Tier II and Tier III cities has led to the emergence of a greater need for sophisticated life insurance products

- Changes in the regulatory environment has had a path-breaking impact on the development of the industry

Pramerica Life At a Glance

149 years@

Prudential legacy

99.06%^

Claim settlement ratio

133#

Branches pan india

3219#

Employees across india

Earning Potential

Contribution = Compensation

With each passing year, your efforts will be rewarded with additional earnings..

| First Year Earnings | |

|---|---|

| One Sale-Average Premium | Rs. 25,000 |

| Average Premium for 4 Policies | Rs. 1,00,000 Monthly (Rs. 12,00,000 Annually) |

| Average Commission | 30% |

| FYC Earned Rs.25, 000 X 30% | Rs. 7,500 |

| Earnings in Month 1 for 4 Policies | Rs. 30,000 Rs.7,500 X 4 |

| In 12 Months Rs. 30,000 X 12 | Rs.3,60,000 |

| Total Earnings | Rs.3,60,000 |

| Second Year Earnings | |

|---|---|

| One Sale-Average Premium | Rs.27, 500 (10% Increase) |

| Average Commission | 30% |

| FYC Earned Rs.27,500 X 30% | Rs. 8,250 |

| Earnings in Month 1 for 5 Policies Rs.8,250 X 5 | Rs. 41,250 |

| In 12 Months Rs.41,250 X 12 | Rs. 4,95,000 |

| Renewal Commission @ 5% Rs. 12,00,000 X 5% | Rs. 60,000 |

| Total Earnings | Rs. 5,55,000 |

How to become An Advisor

Documents for the IRDA license to sell insurance products:

| S No. | Documents |

|---|---|

| 1. | Application Form |

| 2. | Two recent coloured passport sized photographs |

| 3. | Self attested documents: (a) DOB Proof (Pan Card, Passport, Driving License) (b) Highest educational qualification proof (10th and 12th proofs are mandatory) (c) Address Proof of correspondence address - Aadhaar Card/Passport (d) Photo ID Proof- Aadhaar Card/Pan Card/Passport (e) Pan Card |

| 4. | Cancelled cheque with name of the candidate and the bank account number printed on it for credit of commission |

| 5. | A copy of the latest mobile bill (not older than 6 months)/landline bill/electricity bill in the name of the candidate |

| 6. | Bank statement for the last 6 months |

| 7. | Additional documents in Transfer cases (previous license holder candidate) a) A copy of the IRDA license (life/general/composite) b) A copy of the NO OBJECTION CERTIFICATE (NOC) issued by the previous insurer/copy of the Resignation Letter along with the Request for issuance of the NOC duly acknowledged by the previous insurer |

Our Training Programs are designed to keep you updated on trends so that you are equipped to perform your best, these include-

- Classroom-based Training Programs

- Technology-led Training (E-learning)

- On-the-job Training in the able guidance of Sales Leaders

| Program Name | Duration | Mode of Training | Objective |

|---|---|---|---|

| IC 38 Training | 25 Hours | Online Training | Mandatory regulatory training & test for getting IRDA license to sell life insurance products. |

| IC 38 Training | 2 Days | Classroom Training | An interactive Instructor led classroom program, giving a complete understanding about the basics of Life Insurance and to pass IC-38 exam. |

| Pehla Kadam | 2 Days | Role Plays based Classroom Training | An interactive Instructor led classroom program to align the newly on boarded agents to the Organization History, MVV, understand Products, their pitches and their earning potential. |

| Goal Setting session | 0.5 Day | Classroom Training | To help our agents achieve their goals with the help of their respective SM/OH |

| Saturday Pathshala | 2-3 Hrs | Classroom Training | Regular training capsules, held at Branch Offices, preferably on Saturdays, on numerous topics like Tax Planning, Communication Skills, closing Sales techniques etc. |

| Sampark | 2 Hours | Branch engagement programs for Company and Market updates |

Our Offerings

What if you had the chance to start a business that would:

Success Stories

Celebration and Events

At Pramerica Life, we take appreciation and recognition seriously. Conventions and celebrations are important occasions where our top agents get the opportunity to mingle with senior management and are felicitated for their performance. Here are a few glimpses of our celebrations:

@ Source: prudential.com

^ Individual Death Claim Paid Ratio as per audited financials for FY 2023-24

# As on July 2024

Pay Premium Online

Click on the option as per your convenience

For new policy application

For existing policy

For existing policy

For existing ULIP policy

.png)