When everything is instant,

why wait for policy issuance?

PRESENTING

Pramerica Life Rakshak Smart

A Non-Linked Non-Participating Individual Savings Life Insurance Plan

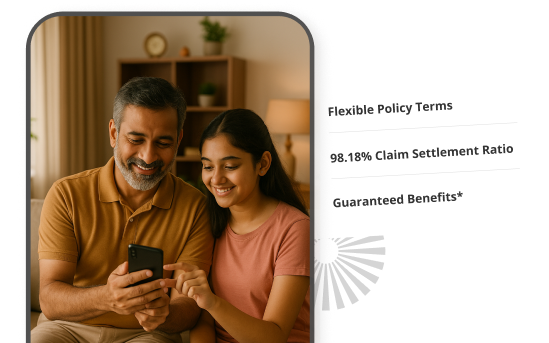

Plan for your dreams with confidence

With life full of surprises, you need a plan that’s steady. Pramerica Life Rakshak Smart offers guaranteed protection—so you can chase your dreams knowing your loved ones are covered.

Consult our experts

Share your details to know the best-suited insurance plan for you.

How the Plan Works?

How the Plan Works?

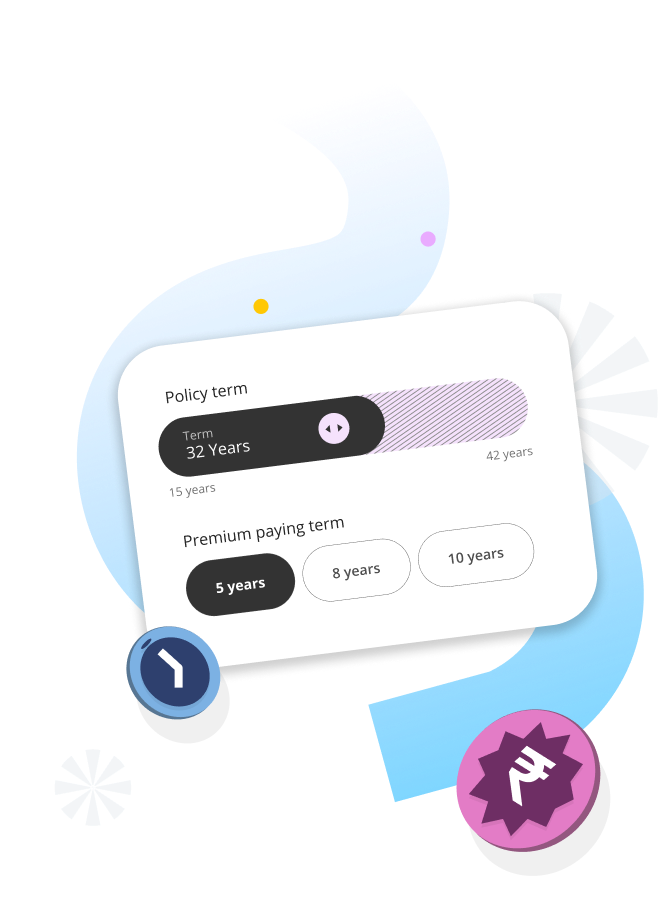

01 Choose your Policy Term and Premium Paying Term

02 Choose your Base Sum Assured

03 Fill your details to get your guaranteed life coverage and income

This plan is best suited for

Frequently Asked Questions

What is life insurance?

Life insurance is a contract that pledges payment of an amount to the person assured (or his nominee) on the happening of the event insured against. The contract is valid for payment of the insured amount during:

- The date of maturity or

- Specified dates at periodic intervals

- Unfortunate death if it occurs earlier

Among other things, the contract also provides for the payment of premiums periodically to the company by the policyholder. Life insurance is universally acknowledged as an institution which eliminates risk, substituting certainty for uncertainty and comes to the timely aid of the family in the unfortunate event of the breadwinner's death. Life insurance is concerned with two hazards that stand across the life path of every person:

- That of dying prematurely leaves a dependent family to fend for itr

- That of living till old age without visible means of support

What death benefit my nominee will get?

In the unfortunate event of death of the Life Insured during the Policy Term while the policy is in-force on the date of death, the beneficiary shall receive Sum Assured on Death and Accrued Annual Guaranteed Additions till the date of death.

What maturity benefit will I get?

On survival of the life insured till the end of the policy term and provided all due premiums have been paid, you shall receive the maturity benefit as sum of guaranteed income# and savings booster.

Will I get any Tax benefits?

Yes, premiums paid under this plan may be eligible for tax exemptions, subject to the applicable tax laws and conditions

What will happen if I surrender a policy?

It is advisable to pay premiums for the entire premium payment term to enjoy maximum benefits under the policy. If your policy acquired a surrender value, on payment of at least first two full years’ premium and you choose to discontinue your policy, you will be entitled to receive Surrender Value which will be higher of the guaranteed surrender value (GSV) or special surrender value (SSV) of the policy.

Are my existing policies enough for me? (I already have life insurance policies; what should I do?)

Your need for protection is not fixed as life progresses; new developments happen, and these developments impact the extent to which you need protection. Hence, the requirement for protection should be reviewed periodically, and if there is a shortfall, it should be covered as soon as possible by buying additional insurance cover. For illustration, some of the events in your life that are likely to have an impact on the levels of protection that you need are:

- You or your children are getting married.

- You have become or are becoming a parent

- Your parents or spouse have retired/are retiring and are / will be financially dependent on you.

- The health of your dependents or your health has taken a downturn.

- You have acquired large capital assets like a new home or a car.

- Your children are about to enter school or college.

- You or your spouse has a large salary raise, or the family income levels have significantly increased.

You should consult your agent/ financial advisor if any events like those mentioned above have happened to evaluate if your need for protection has changed.

Why is it better to buy insurance at an early age?

There are many advantages of buying an insurance policy as early as possible:

- The consideration for an insurance policy or the premium is significantly lower at younger ages (the reason for that is as you grow older, the mortality risk is greater, and hence, insurance companies would charge a higher premium to cover that risk). By buying a policy at an early age, you would be able to protect your dependents against an unforeseen event like death at a much lower overall cost.

- As you grow older, you will likely suffer from health problems, and obtaining insurance could become difficult at that stage, even if you want to.

- If you are buying insurance with a view to create a large sum of money at a pre-determined age to meet certain planned expenses like your children’s education or for your post-retirement expenses, then saving early on in your life is highly beneficial.

If you start saving late, you must keep much more or for longer durations to get the same amount of money.

Who can buy a policy?

Any person who has attained majority and is eligible to enter into a valid contract can insure themselves and those in whom they have insurable interest. Policies can also be taken, subject to certain conditions, on the life of one's spouse or children. While underwriting proposals, the insurance company considers certain factors, such as the policyholder's state of health, the proposer's income, and other relevant factors.

Why do I need life insurance?

Life is uncertain, and it is impossible to predict the different events that can occur. However, there is always a need to earn income to support yourself and your dependents in case of any eventuality. Life insurance provides financial security in the wake of unfortunate events like death or the inability to earn due to physical disabilities. Besides providing financial protection in the case of one's untimely death, it can be used to accumulate a kitty for your old age, build assets systematically, fund your child's education, and save on taxes.

Can I change the frequency of payment for my policy?

Yes, you can change the premium frequency from low (annual) to a higher frequency (bi-annual or monthly) or vice-versa.

Can I change my nominee?

Yes. You can change your nominee at any time till the maturity date. All you need to do is to inform us about the change through the specified form.

Life cover

Life cover Avail Tax Benefits as per prevailing tax laws

Avail Tax Benefits as per prevailing tax laws